Disclaimer: I am not a subject matter expert, and am not a financial advisor on whether or not you should invest in cryptocurrencies or Stellar. I have tried my best to maintain accuracy but everything is purely my opinion. I will be adding more and revising to make this article better and better.

Cryptocurrency is still so new that it can be quite difficult for the general public to understand how specific cryptocurrencies work and their key differentiators.

After extensive research over the weeks, I’ve finally been able to answer some of my biggest questions regarding one of my favorite cryptocurrencies, built on the Stellar network, called Lumens.

The main goals of Stellar are easily understandable, whereas the technology can be extremely difficult to understand, especially if you’re someone like me and don’t have a strong technical background in computer science or fintech (financial technology).

Recently, I set forth on a mission to try to really understand the big picture of how Stellar’s technology can impact the world, how the technology works, why it’s better than other blockchain technologies, and what may drive the Lumen token higher and higher.

After weeks of research, including reading the Stellar whitepaper; the Stellar.org website, blog, and publications; and a vast array of talks given by Jed McCaleb, Dr. David Mazières, Joyce Kim, and other key opinion leaders, I’ve finally compiled enough information to explain the goals of Stellar Foundation, the problem it solves, the solution it offers, and how it works on a social and economic level.

As a disclaimer, although I’ve thoroughly researched this subject, I am not a computer scientist, nor am I an expert in financial technology. My background is as an entrepreneur and as a marketer — this means that this piece is my point of view and I try to back it up with sources as necessary. I plan to evolve and edit this piece as I fill in the gaps and learn more about the Stellar project.

Stellar foundation aims to solve two key problems. I’d like to start by explaining:

- How Stellar can make impactful social changes, and

- Why Stellar’s underlying technology is superior to other blockchain technologies such as Bitcoin.

Stellar’s Social Mission: To provide financial services to the unbanked

First off, it’s expensive to be poor.

What do I mean? Well, if you’re in a developed country, this probably isn’t a problem you encounter on a daily basis. If I want to send money to a friend, I can use a variety of tools like Venmo in the United States, or WeChat Pay in China to instantly transfer funds.

However, when someone in Tanzania wants to transfer funds to someone else in Kenya, they pay an average of 22% of the total transfer value in network and bank service fees.

Oftentimes, migrant workers in developed nations pay a fortune to companies like Western Union to sending money back home to family members. In fact, Western Union made $5.6 billion dollars moving just $85 billion dollars in 2014. Not to mention it usually takes a long time for the funds to actually come through, and for some countries, you simply can’t transfer the money across borders at all.

Secondly, today, 2 billion adults are unbanked. Most of these people reside in lower-income developing countries where it’s hard to find access to a trustworthy or reputable bank. It isn’t uncommon for the bank itself to commit fraud against you and steal your funds.

Being unbanked has bigger repercussions than simply not being able to store your money in a bank account. Once again, this isn’t so intuitive for someone from a developed country because we take financial services for granted. Imagine if you literally could not transfer funds to other people, could not invest in anything, could not save money, and literally had no means of connecting with or participating in the global economy.

How Stellar can provide services for the unbanked through the Stellar Decentralized Exchange (SDEX)

On a technological level, cryptocurrency in itself is an amazing breakthrough that has allowed for the decentralization of currency. Previously, there was a major problem when it came to sending money digitally to someone else without having a central ‘trusted’ authority such as a bank or middleman.

The reason you need a centralized trusted authority is to essentially verify that you are giving someone $10 (so $10 gets deducted from your account) and the person you send it to gets $10 credited to their account (minus fees when applicable). Without this central authority, people can game the system.

Think of when you email a file to someone else. There is no central authority that tracks all files on computers, so when I send a file to someone else, essentially I’m making a copy of that file and sending it over to them. However, I can’t do that with money, otherwise I’d be making a copy of my digital currency and sending it to someone without it being subtracted from my account. This is the classic ‘double-spend’ issue that historically has been mediated by a central bank or trusted institution.

The problem with always having a trusted intermediary is that you’ll always be relying on a middle man to send your money to someone else. This also means that you’ll always be at the mercy of a financial institution if they choose to raise fees. Even worse, not all banks play along with each other, and anyone who’s sent funds overseas knows you literally have to deal with numerous financial institutions all with their individual fees to get money to someone else.

Today, if I wanted to send $100 to my friend in Eastern Europe from the United States through a bank, I’d get hit with a $25 wire transfer fee and she’d get hit with a $25 wire transfer fee which results in a net loss of 50% due to fees.

Then, Bitcoin came along — a secure way to send digital currencies, cutting out the middleman and thereby decentralizing currency.

However, Bitcoin has major problems.

It is based on a ‘proof-of-work’ system, which in short is a computational way to verify the accuracy of transactions in a secure way. The main thing you need to know about proof-of-work is that a number of people all over the world with computers, who we call miners, use a crazy amount of computational power to solve puzzles. Since the puzzles take so much time and power to solve, it is difficult for evil people to change the Bitcoin blockchain which in turn guarantees security.

Once transactions are confirmed, they are added to a global, decentralized ledger. A ledger is simply public documentation log that everyone agrees upon that will note Person A sent X amount to Person B, etc.

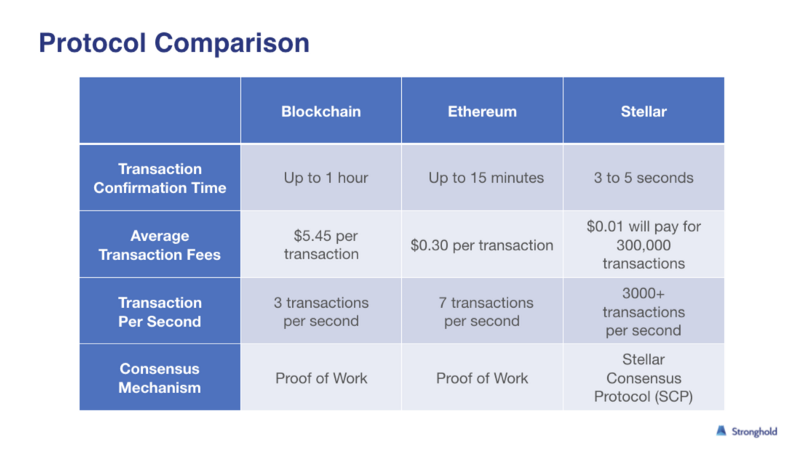

Bitcoin’s ‘proof-of-work’ system results in large problems when it comes to scalability and speed. Because each transaction needs to be verified through computational puzzles, sending currency is slow, oftentimes up to 30 minutes, and extremely expensive. Imagine trying to send $30 but being nicked $15 in fees. Due to the demand for computing power to confirm Bitcoin transactions, the maximum number of transactions per second with Bitcoin is somewhere around 3–7. Visa, on the other hand, is well over 20,000 transactions per second.

Then, factor in the environmental concerns. Today, Bitcoin uses as much energy as the entire country of Denmark — and it doesn’t even have widespread adoption yet.

As you can imagine, numerous other cryptocurrencies set forth to try to solve these major problems involving decentralization, speed, and energy consumption. At the same time, alternative cryptocurrencies also need to ensure the principles of “liveness” (allowing the system to function in the presence of failures and attacks) with “security” (ensuring that only accurate, consistent, and correct values are agreed upon).

The Stellar Consensus Protocol (SCP) was created to address these problems.

How Does Stellar Lumens Work on a Technical Level?: The Stellar Consensus Protocol (SCP)

First, we have to talk a bit about the Stellar Consensus Protocol (SCP) which was created by Dr. David Mazières, a professor of computer science at Stanford University

The SCP took some time for me to wrap my head around. Essentially, the SCP is a way to tackle the scalability and speed problems Bitcoin has which were detailed above.

Today, people expect the speed of a digital transaction to be a few seconds. This means that the Stellar network needs to reach consensus very fast while ensuring accuracy. Consensus is a vital component of decentralized networks which involves the entire network reaching agreement on a set of values. If consensus is not met, you then have a network all saying and recording different things.

Due to these speed issues, SCP cannot use a similar consensus protocol to Bitcoin’s ‘proof-of-work,’ but it does still have to maintain accuracy and security.

This is challenging because a global network of decentralized servers has to agree that I sent you $10, you received $10, and $10 was deducted from my account. There also has to be enough protection if a bad actor tries to take down the network.

These attacks are often done through evil or untrustworthy hacked nodes that try to break the consensus in different parts of a distributed network.

All of the consensus has to be done accurately in a matter of seconds, otherwise you will have a scaling problem. The SCP utilizes what they call a Federation in order to fulfill fast consensus. A Federation is just a group of trusted nodes that can decide to trust other nodes and thereby add to consensus. Any entity can set up and run a server, but that doesn’t mean that everyone else is going to trust that entity.

Each node communicates with one another and accepts verification and reaches consensus every 2–5 seconds with other trusted peers. Eventually you have an entire network of peers that trust each other mutually through other trusted peers. This is how the SCP forms consensus about who can actually form consensus in the first place without creating a central body that owns it all. Your end result is completely synced ledger every 2–5 seconds.

Comparison of Stellar versus Blockchain (Bitcoin & Ethereum) — Courtesy of Stronghold

Phew. That’s still a bit confusing for most people.

I’d like to break it down into a more practical example now.

Friends of friends: How the Federation is like Facebook

Think of Facebook, and imagine each person is a “node”. You usually will choose to accept friend requests from people you know. You might even accept the requests of friends of your friends, because you trust the people you know to know more good people. You and your friends make up a ‘quorum slice.’ You can imagine that even though you aren’t connected to every profile on Facebook, it’s likely that through mutual friends, you have a certain level of interconnectedness across the entire network.

Now let’s bring it back to real world applications. All the big banks have their friends who make up their quorum slice. Then a bunch of tech non-profits also have their own quorum slice. These quorum slices tend to mimic real life where similar people or organizations tend to group together. On Facebook, you have your group of friends and I have mine: separate quorum slices of the same extended network.

The problem here is that different quorum slices can disagree about something, which means the entire network won’t have consensus. To solve this problem, each node adds a few other nodes from other quorum slices. For example, a few non-profits can add a few trusted banks, vice versa. This would be the equivalent if you, the reader, added a few of my friends on Facebook.

What we’re trying to do here is both create interdependence across an entire network, but also create groups “quorum slices” that aren’t likely to collude with one another to attack the entire network. It’s highly unlikely that a quorum slice of banks is going to collude with a quorum slice of non-for-profits and a quorum slice of tech companies.

Now it can be shown that individual nodes won’t agree to a value or reach consensus unless the bulk of their other peers also agree. However, due to quorum slices having high levels of overlapping interdependence, you don’t need every node on the network to talk directly to each other in order to reach consensus.

Through the way the network is set up, the Stellar consensus protocol can balance both the principle of “liveness” with “security”.

When I decide to make a $10 transaction on the Stellar network, the public ledger records this, and if enough trusted nodes are in agreement, then it will reach consensus across the entire system.

Now let’s say that there were a bunch of nodes in a quorum slice that wanted to collude to game the network. The other, honest quorum slices won’t agree to the collusion and this prevents the value from being accepted — unless somehow enough trusted nodes across many quorum slices were hacked or in on the collusion.

This scenario is highly unlikely because it is extremely difficult for a no-name entity to run hundreds of nodes and somehow get numerous extremely trusted nodes on the network to trust you.

Therefore, although any entity can set up a server, this doesn’t mean that other reputable nodes will choose to trust you.

Could trusted entities potentially launch wide-scale fraudulent transactions that get verified on the public ledger? The answer is possibly… but it would be extremely difficult for low rewards. Realistically, to pull this off, a major bank or trusted organization would have to gain control of 51% of trusted nodes.

Jed McCaleb previously mentioned that, essentially, if your trusted bank or organization is going to steal your funds, they’ll probably do it either way, with or without the Stellar network. By trying to take over the Stellar network, in the end, it would be a massive feat that would be easy to trace and not worth the time and effort.

An oversimplification of the entire SCP would be: “Numerous nodes across the network vote in order to create consensus, and the voting gives more bias towards trusted nodes.”

Ultimately, the SCP adds social identity and reputation into the equation, whereas that is not necessary with a ‘proof-of-work’ consensus mechanism. Since you have to use a trust line, there is a trade off between Stellar versus other digital currencies. In many situations, a compelling argument can be made where the pros outweigh the cons for SCP vs. ‘proof-of-work.’

The Stellar Decentralized Exchange (SDEX)

The Stellar Decentralized Exchange is an exchange that allows currencies to be traded and transferred across borders. To best understand how this exchange works, it should be viewed separately from the Stellar Consensus Protocol. Mainly, SDEX relies on the SCP to ensure the documentation of important transaction details onto the public ledger.

Currently, in order for a bank to send money to another bank, they have to use a communications network that works in their country (like ACH or SWIFT) or use something like Western Union or another courier service.

Let’s say I’d like to use my Chase bank account to send USD to my friend in China via Bank of China and so he can withdraw it in his local currency, CNY.

First off, there’d have to be a trust line in place between Chase Bank and Bank of China for the respective currencies. It would look something like this:

Chase Bank / USD <fees/delays> Bank of China / USD <fees/delays> Bank of China / CNY

With the Stellar exchange, multiple currencies can be actively traded by either the bank themselves or a market maker (middleman) directly on the exchange.

The Stellar network uses lumens. A lumen is a native asset on the Stellar network. This is another way of saying it is a unit that has some sort of value built directly on the Stellar network. Lumens can be used as a bridge currency if there aren’t any buy/sell offers on the exchange for the selected currencies.

Think of lumens as an intermediate currency that is trusted by both parties to transfer value from one asset to another.

It would look something like this if I wanted to send USD from Chase Bank to my friend’s bank, Bank of China, in his local currency.

Option A: Chase Bank / USD <is there a trade offer for USD/CNY, and is it at a better rate than option B?> Bank of China / CNY

Option B: Chase Bank / USD -> XLM ; XLM -> Bank of China / CNY.

Therefore, lumens have the ability to act as a bridge currency between two different currency pairs.

Another cool feature of the SDEX is that you can technically trade much more than just different currencies. You can trade anything. In fact, someone recently was selling shares of his goat farm in the Dominican Republic on the SDEX.

There’s a secondary usage to lumens as well — they serve as an anti-spam mechanism because each transaction on the lumen network has a minor fee. This helps to mitigate DoS (Denial of Service) attacks by limiting the volume of fake transactions that try to flood the system.

Finally, with enough adoption, the lumen will likely be able to function as a digital currency itself. It would be able to move funds directly to other users across the network.

What drives the price of a lumen?

There are so many different tokens in the blockchain space. One of the most important questions revolves around the justification for the growth of a coin.

Bitcoin’s major utility at this point is a storage of value due to the finite supply of 21 million Bitcoins. Similar to gold, scarcity is usually valued and because there can only ever be 21 million Bitcoins, people attribute value to it.

Unfortunately, due to speed and scalability issues, at this point Bitcoin is unable to have much utility as a P2P (Peer to Peer) decentralized money transfer platform. Gold has usage aside from just a store of value — in fact it is used in many electronics and jewelry.

The value of Lumens will increase with more adoption, however likely on a smaller basis when compared to Bitcoin due to the pre-mined 100 billion available tokens. Quantity affects scarcity which is why the price of a Lumen is much less than the price of a Bitcoin.

It is difficult to speculate what the value of a lumen should be and can be in the future because it is so dependent on widespread adoption and the success of the technology.

Lumens being used as a bridge currency by the Stellar Decentralized Exchange can also affect the valuation of what each individual lumen is worth. For example, if you were to send $100 USD to another currency, and lumens were worth $1, then you’d need 100 lumens to bridge it. However, if lumens were worth $2, then you’d only need 50 lumens to bridge it. There are a finite number of lumens in supply, so naturally valuation may increase with adoption.

As more people use lumens, lumens will need to represent larger values in order to keep up with demand.

Other Thoughts

I’m curious about a few other topics as well, including potential problems that may arise, preventing Stellar from reaching its goals.

First off, one of Stellar’s major missions is to help the unbanked become bankable. The problem is that oftentimes in developing countries, the problem itself is trusting the bank. If banks were trusted, then it wouldn’t be as big of an issue for people who are ‘unbankable.’

This presents a sort of catch-22 because in order for unbankable people to become bankable and utilize Stellar, they’d still have to trust an anchor, aka the bank.

If you still need to utilize a bank as a trust line, then you still ultimately may be at the mercy of the bank when it comes to fees, services charges, and other regulations.

The thought is that there will always be banks and financial institutions in the world. Stellar is able to enable help better facilitate currency exchanges across borders via the SDEX. People can choose to transfer lumens directly which bypass the bank, or still use banking institutions to send money.

Finally, there have to be enough incentives for banks and other companies to utilize the Stellar network. Right now, in my understanding, one of the key incentives would be to help speed up how quickly payments can be completed in cross-border transactions in different currencies. This doesn’t necessarily mean that as the end user, consumers would reap the all benefits because banks ultimately are for-profit entities and I cannot imagine Western Union would intentionally reduce their profit margin for the sake of consumers. However, it’s likely that due to the increased speed and lower costs, some of these benefits would pass on to end users.

A quick recap of what we’ve learned

In summary, the Stellar network is a great network that has fast consensus speed and scalability compared to other mainstream technologies. It appears to be a good platform to launch new ICOs (the equivalent of an Initial Public Offering in the stock market, but with digital tokens) compared to Ethereum, and we have seen prominent ICOs move their tokens over to the Stellar network completely, including Kik Messenger.

Other mainstream adoptions of the Stellar network include FairX, a fiat for crypto-based exchange set to rival Coinbase in the next few months. FairX would allow you to use cash (fiat currency) to buy digital token assets like Bitcoin, Lumens and more.

Beyond this, the Stellar Foundation’s original goal was to make cross-border transactions as painless as possible and they’ve chosen to start this not-for-profit mission in areas of the world that are unbanked and disconnected from the world’s economic network. By first acquiring adoption in niche regions, I believe Stellar has a good chance to make a wider impact after initial proof of concept and adoption.

Other ICOs and the FairX exchange on Stellar’s network will also be a great display of scalability, reliability, and speed, which will hopefully give more and more credibility for other entities to build on top of Stellar.

I’m personally excited to be a part of the Stellar community. It is one of the few coins where I can intuitively understand the mission and the steps they are taking to get to their goal, even though the underlying consensus protocol can be challenging.

Please feel free to drop any messages, comments, or questions that you might have below. I promise to do my research and help explain Stellar lumens in the most practical way possible.